contra costa county sales tax calculator

Comal County has one of the highest median property taxes in the United States and is ranked 201st of the 3143 counties in order of median property taxes. Comal County collects on average 148 of a propertys assessed fair market value as property tax.

What Do Your Property Taxes Really Pay For

The Pleasant HillContra Costa Centre Station garage was built with Federal Highway funds as a rideshare facility.

. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. CONTRA COSTA COUNTY Exp. Chicago Title Transfer Tax and City Tax Calculator.

24 Sales tax paid to DMV enter the total amount from column C from CDTFA-531-MV. Accordingly drivers who carpool or use other public transit may park in the garage as long as they pay the parking fee at the parking paymentvalidation machine located in the non-paid area outside the station fare gates. The median property tax in Comal County Texas is 2782 per year for a home worth the median value of 187400.

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. 3-31-21 025 Discontinued0100 CONTRA COSTA COUNTY Eff. Adjusted monthly interest rate is INTEREST RATE CALCULATOR INTEREST 2900 30 TOTAL AMOUNT DUE AND PAYABLE add lines 25 28.

Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

San Francisco Bay Area Transfer Tax By City And County Updated For 2021 Torii Homes

California State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application

Marin County California Property Taxes 2022

San Mateo County Ca Property Tax Search And Records Propertyshark

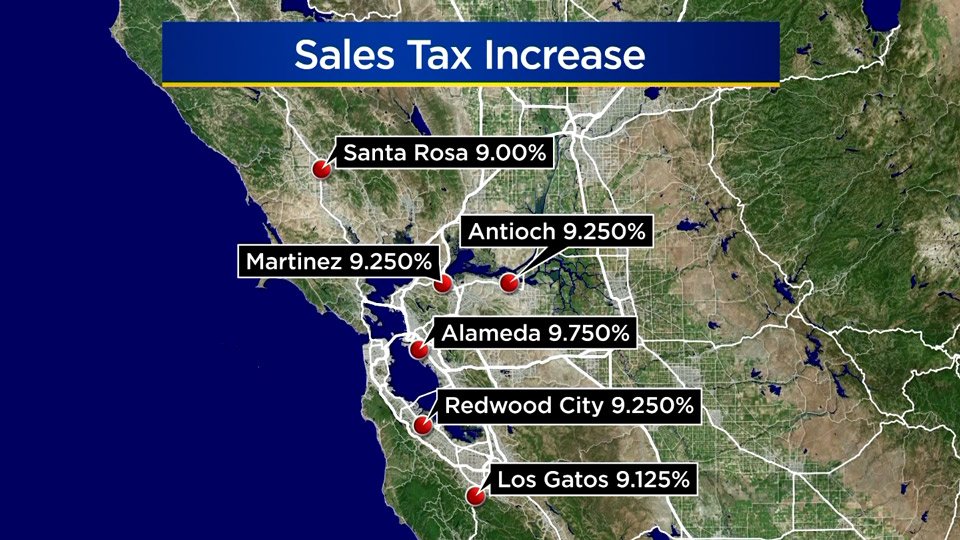

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco

Los Angeles County Property Tax Rate 2015 Property Walls

Riverside County Ca Property Tax Search And Records Propertyshark

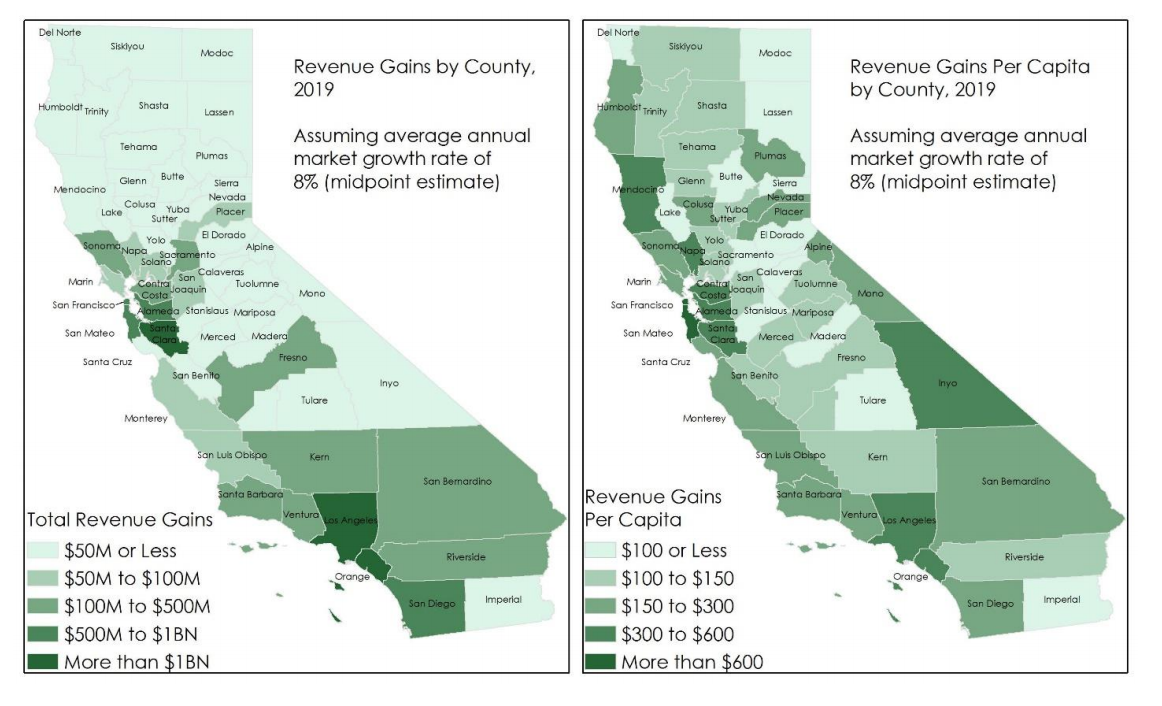

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review